Table of Contents

- Advanced Micro Devices Stock News: AMD advances for fourth week in a row

- AMD Stock Has Created an Interesting Problem with Its Massive Success

- AMD Stock Price Today: Advanced Micro Devices, Inc. looks poised to ...

- All Hail Advanced Micro Devices, the New King of Semiconductors ...

- How, When and Why to Buy AMD Stock in Today’s Market

- AMD Stock Price and Chart — TradingView

- Here's The Price I'll Start Buying AMD Stock (NASDAQ:AMD) | Seeking Alpha

- AMD Share Price and News / Advanced Micro Devices, Inc. (NASDAQ)

- Advanced Micro Devices Stock Forecast and News: AMD opens higher ...

- How, When and Why to Buy AMD Stock in Today’s Market

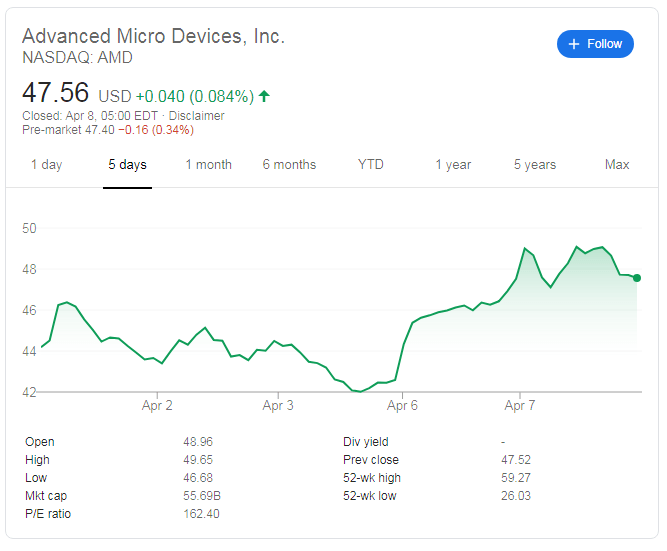

Current AMD Stock Price

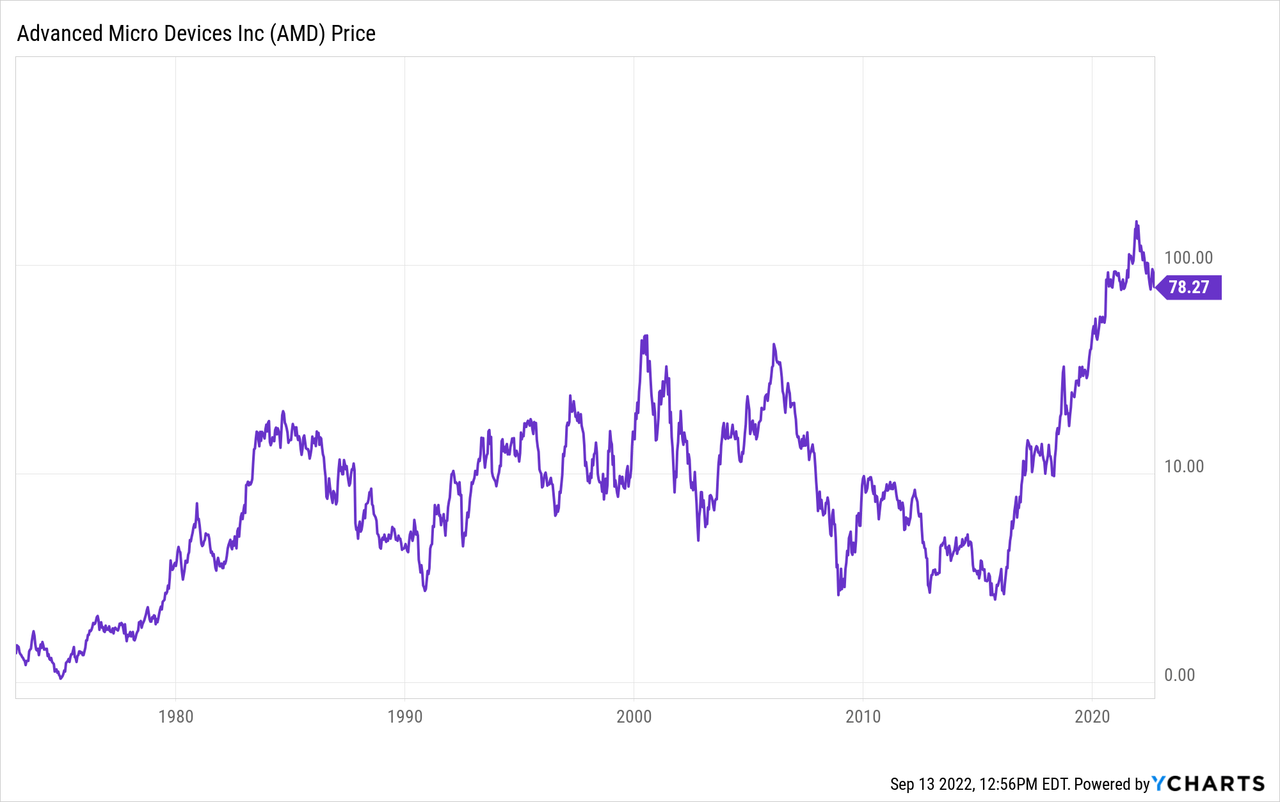

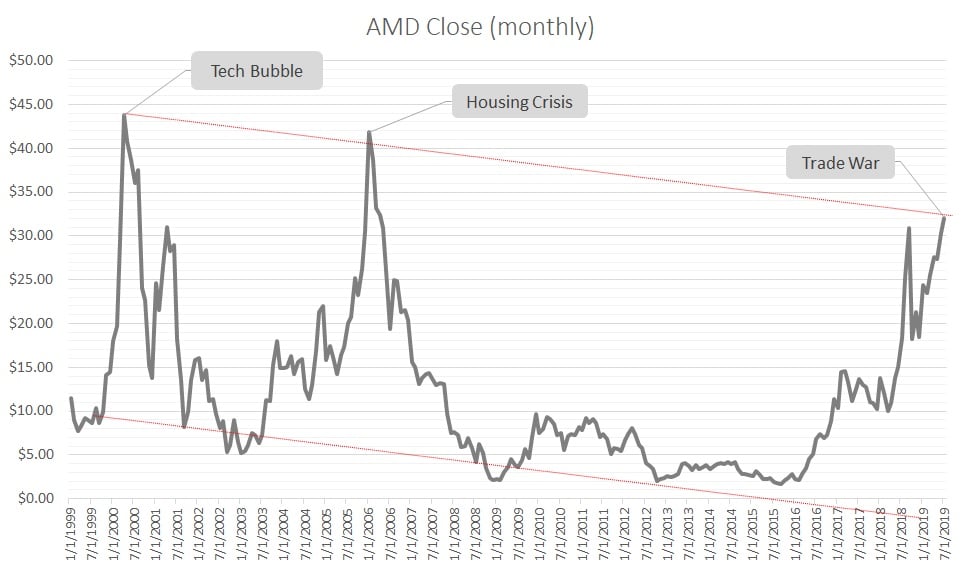

Recent Performance

Factors Influencing AMD Stock Price

Several factors contribute to the volatility of AMD's stock price. These include: - Financial Reports: Quarterly earnings reports are crucial, as they provide insight into the company's revenue, profitability, and future outlook. Positive reports can boost the stock price, while disappointing results can lead to a decline. - Market Competition: The competition in the semiconductor industry is fierce, with AMD competing against giants like Intel and NVIDIA. Gains or losses in market share can significantly impact the stock price. - Technological Advancements: The tech industry is characterized by rapid innovation. AMD's ability to develop and market new, competitive technologies can influence investor confidence and, consequently, the stock price. - Global Economic Conditions: Economic downturns or upswings can affect demand for AMD's products, thereby influencing the stock price.

Investing in AMD Stock

For investors considering buying or selling AMD stock, it's crucial to conduct thorough research and consider both the short-term and long-term prospects of the company. Given the volatile nature of tech stocks, investors should be prepared for fluctuations in the stock price. Diversifying a portfolio and setting clear investment goals can help mitigate risks. The AMD stock price, as reflected on platforms like Investing.com, offers a snapshot of the company's current market valuation. As with any investment, understanding the factors that influence the stock price and staying abreast of market news is key to making informed decisions. Whether you're a seasoned investor or just starting out, keeping a close eye on AMD and the broader tech sector can provide valuable insights into the world of stock investing. For the most current AMD stock price and to stay updated on the latest market movements, visit Investing.com. With real-time data and comprehensive analysis tools, investors can navigate the complex world of stock trading with confidence.Disclaimer: The information provided in this article is for general purposes only and should not be considered as investment advice. It's always recommended to consult with a financial advisor before making any investment decisions.